Happy to hear your tips, but predicting prices of commodities, exchange rates or share prices is nigh on impossible on a short term basis. On a longer term basis, it is a little easier, especially when you take a look at a few graphs and reflect on that prices of goods in Australia has remained static for quite some time.

Starting with the Iron Ore price, in 2018 it was at about $70 USD/t, rising to approximately $90 USD/t through 2019, ignoring the blips. 2020 saw steady increases of around 5% per MONTH, and the price now after a small drop is about $160 USD/t. That’s roughly a doubling in raw materials cost. Many other commodity prices have followed similar trends, that is, substantial and sustained increases. This has not been translated to the prices of the finished goods to anywhere near this extent (partly due to locked in supply contracts rather than spot prices). In fact, most goods prices have remained stagnant for a few years.

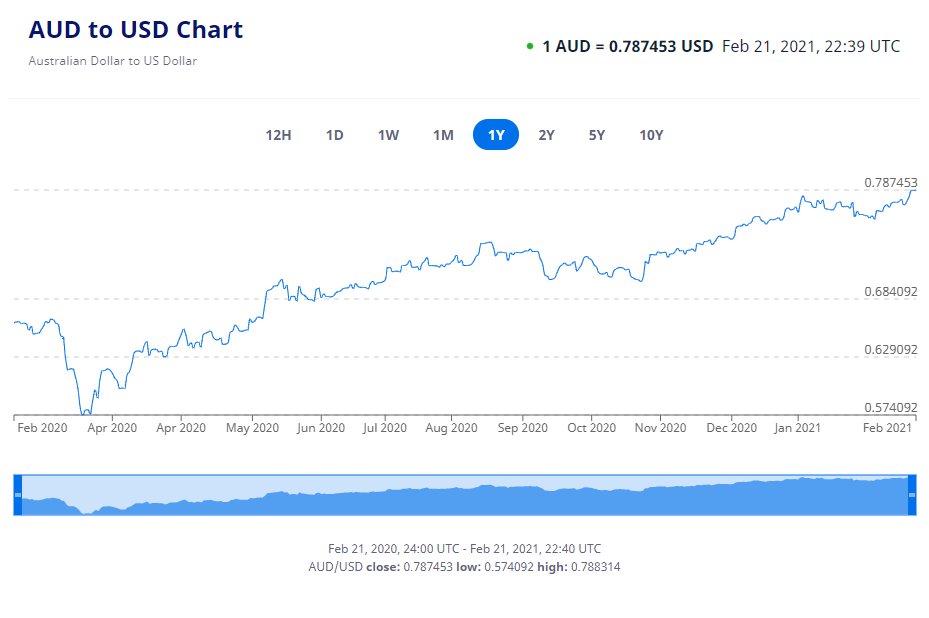

Somewhat offsetting this has been that the Australian dollar has been increasing against the USD (and other currencies). In early 2020 the exchange rate was 0.66, rising about 1 cent every month, and now sits at around 0.77. This has helped mitigate the price increases of goods in Australia by 15-20%, which is well short of the cost increases of the raw materials.

Lastly, most goods we purchase in Australia are manufactured overseas, which means they predominantly arrive in containers by sea. Shipping costs have for basically the last year been 2 – 3 times higher than they were pre-Covid, and the forecast is for this to stay stagnant for at least 3 months, probably more likely to the end of the year. The cost of transport is therefore now a significant impost on the landed costs of all goods.

So what does all this mean? Prices for goods charged nearly always lag behind the leading indicators, that is, in a competitive market companies selling goods are reluctant to increase prices until the cost increase has flowed through. Add in ongoing supply chain issues causing a shortage of goods versus demand (look for instance at used motor vehicle prices as a result of the low availability of many new car models), and it has turned into a market where availability is now also a factor. Shortages have a tendency to push up prices.

With everyone in the same boat, it would be fair to bet that the price of nearly everything in our industry as well as general goods our society buys are going to increase this year. If there are any metal based goods in particular that you require, it would seem to be a good move to bring forward any purchases to beat the price rises.

On a positive note for Australia, we are still heavily dependent on our resources sector, so even if commodity prices drop off a little, this trend should be very good for us as a nation, and will help cushion us from global uncertainties, but doesn’t make us immune from the overall trends.

In closing:

“Either you deal with what is the reality, or you can be sure that reality is going to deal with you” – Alex Haley

As always, onwards and upwards!

Fred Carlsson

General Manager